A pay stub is a document that serves as a record of an employee’s paid wages in addition to taxes and deductions withheld. We provide more than 50 free pay stub templates to help you comply with laws in the 41 states that require employers provide them—even if paying with cash or direct deposit.

Downloadable Pay Stub Templates

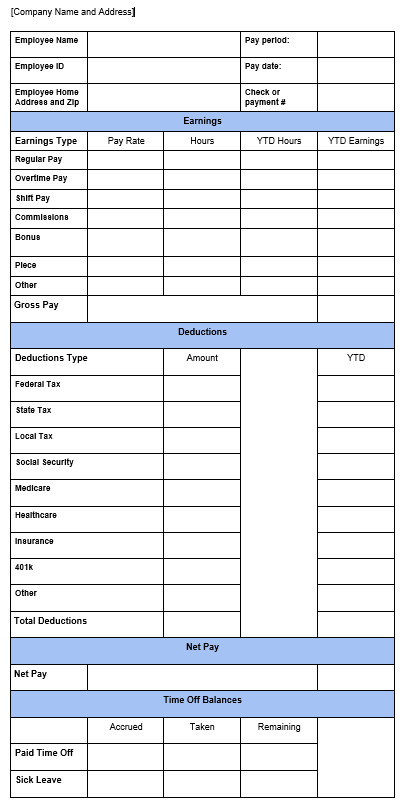

Here is a general downloadable pay stub template that you can open, input your data, save and/or print. It contains all of the basic information fields you may want to document earnings and deductions. Any words or rows you don’t use can be left blank, customized, or deleted from the template to make this work for your business.

You may want to customize your stubs based on the industry in which your business operates. For instance, restaurants may need a method for tracking and reporting tips. Household employers may need space to report expense reimbursements. Payroll software usually provides you with the most flexibility since its pay stubs are formatted to work with businesses in most industries. The caveat is that you have to use the system to process payroll before a stub can be generated.

Here are two downloadable pay stub templates you can use for specific industries:

Pay Stub For Restaurants

Pay Stub For Household Employers

To avoid creating manual pay stubs altogether, consider using a payroll service like Gusto. In addition to offering your employees pay stubs, you can also let them manage their account information online or via a mobile device and print their own payroll documents.

This is a sample pay stub you can generate from Gusto’s software

The pay stubs that Gusto generates (and stores) contain information on hours worked, pay rates, taxes, and deductions, and benefit contributions. Sign up for a free trial today.

What a Pay Stub Template Should Include

State law typically dictates the information you should include on a pay stub. For example, some states like Arkansas and South Dakota don’t require employers to provide pay stubs to employees at all. Regardless, providing a pay stub is a good practice because it ensures you have solid backup information in the event of an audit.

Sample Pay Stub Template

Although the formatting of pay stubs can vary, you’ll find that most have some of the same information. For instance, a pay stub should always identify the employee and employer. Otherwise, the document is unreliable. It should also be dated and provide calculations that show the employee’s final pay and any taxes withheld.

The most common data fields to include in your pay stub template are:

- Your company’s name and address

- The employee’s name and employee ID

- The pay period for which the payment covered

- The date that the employee was paid

- The gross wages, including regular and overtime pay

- Tips, commissions, or other earnings

- The pre- and post-tax deductions taken from the employee’s earnings

- The employee’s net pay

Example of a pay stub from Nebraska where leave balances are provided

State Pay Stub Requirements

There are 25 states that require employers to provide pay stubs, but only 12 require you to give a physical copy. Nine states have no requirement for businesses to provide pay stubs at all. The remaining states allow employers and their employees to decide together whether pay stubs are provided—employees can opt in or out of receiving them.

For example, in California, details like hours worked, pay period start and end dates, and any piece work—number of units and rate—included on the employee’s paper pay stub. In Nebraska, you’re required to include used and available paid-time-off or sick leave information.

In Florida, unless your workers are in a union, you’re not required to provide a pay stub at all.

Use the map below to determine if your state requires you to provide pay stubs to your employees:

If your state is in purple, you’re allowed to provide electronic pay stubs to employees, but you must also distribute a printed or written copy to those who request it.

If you’re in a state that heavily regulates employee pay stubs, consider outsourcing to a payroll software service, like Gusto. It’s is a full-service payroll provider that helps ensure your pay stubs are calculated correctly and contains the required information for your state. Start a free 30-day trial today.

What Each Field on a Pay Stub Means

Many pay stub templates include useful information such as the number of hours worked during the pay period, year-to-date balances, and paid time off taken. They may also include specific descriptions on the purpose of pre- and post-tax payroll deductions, such as for medical insurance, life insurance, commuter benefits, or uniform fees.

When reviewing free pay stub templates for your business, check that there’s space for basic earnings and deductions information, such as:

- Pay period: Depending on the state requirements, this can be the start and end dates, or the pay period end date only, as shown in the sample Gusto pay stub below.

- Hours worked: Not all states require the hours be listed on the pay stub, but it’s a best practice because you have to track the information to ensure overtime is paid correctly—for example, 40 hours regular plus 6 hours overtime equals 46 hours total in a pay period.

- Gross earnings: This includes hourly earnings, commission earnings, tips, and any earnings based on piecework—each type of earnings is typically shown as a separate line item on the pay stub.

- Required taxes: Include a line to show each of federal taxes, state taxes, unemployment taxes, local taxes (if any), as well as social security taxes deducted from employee earnings.

- Taxable deductions: Include a separate line item for any taxable deductions, such as wage garnishments or uniform fees.

- Tax-free deductions: Include a separate line item for any pre-tax benefits or retirement plan contributions, such as health insurance, life insurance, FSA, HSA, or 401k contributions.

- Time-off balances: This information is helpful to the employee but is also required in states like California and New York that have mandatory paid sick time laws. Derek McIntyre, Chief Operating Officer of Time Clock Plus discusses the importance of tracking paid-time-off (PTO) to comply with new legislation:

“Today, we are seeing an increased need for PTO tracking systems as states and even cities have adopted mandatory sick leave accruals. These policies legislate the requirement to provide one hour of sick time per some number of hours worked and go further to create accrual caps and accrual carryover policies. Combine this with intermittent [family leave], bank time for public sector, bereavement, union contracted leave, work out of office pay, maternity, and standard PTO, and you can see how managing leave has quickly outgrown the Excel spreadsheet.”

—Derek McIntyre, Chief Operating Officer, Time Clock Plus

Where to Find 50+ Other Free Pay Stub Templates

Using a pay stub is an easy way to ensure you’re correctly documenting your employees’ gross earnings, deductions, and net pay. If you’re looking for a wider variety of options to fit your needs, these websites offer over 50 different free pay stub templates that you can use.

- Smartsheet: This online collaboration software provider offers 10 free pay stub templates in PDF and XLS formats.

- PDFFiller: This online fill-in-the-blanks website lets you choose from three free pay stub templates.

- MS Office: If your business already uses the MS Office suite, you’ll be happy to know they offer a free pay stub template in XLS format that calculates basic payment details.

- Free template downloads: This site provides 29 different templates in various formats.

- Template Lab: This site provides 10 free pay stub templates in DOC, PDF, and XLS formats.

Simple blank pay stub template downloadable for free from Template Lab

Online Pay Stub Generators

In addition to free pay stub templates, there are web-based pay stub generators that allow you to input your pay stub information manually. Some, like FormSwift, offer a free trial, and others, like ThePayStubs, allow you to choose your own professional looking templates but cost a few dollars to use.

Here are three online pay stub generators you may find helpful:

- Pay Stub Generator: This free tool on Shopify allows you to input your payroll data manually, and it generates a pay stub for you. It then requests your email address and sends the completed pay stub to you to download or print.

- ThePayStubs: This site provides 10 pay stub templates and provides a tool to let you fill the blanks online. You have to pay about $9 for each pay stub you create. In addition to pay stubs, you can build and print W-2s and 1099-MISC documents as well.

- FormSwift: This free tool allows you to input payroll data and generates a pay stub for you in DOC or PDF format. You can sign up for a subscription that starts at $7.95 per month, and it offers a free seven-day trial.

Input your payroll data, and FormSwift will generate it in DOC or PDF format.

Pay Stub Retention

The United States Department of Labor (DOL) has no mandatory retention requirements for specific documents like pay stubs, but it does require that payroll information be retained for three years. The IRS requires that tax documentation is retained for four years. Some states, like California, require employers to retain payroll documentation for six years.

Frequently Asked Questions (FAQs) About Pay Stub Templates

Here are some common questions employers ask about pay stub templates. If you have additional questions on where to find free pay stub templates or other small business topics, submit them on our forum.

Is it legal to email pay stubs?

Most states allow employers to email pay stubs, especially if they provide the option to print. There are some states like Texas and California that require employers provide both options. Businesses in Hawaii must provide written or printed pay stubs unless the employee consents to receive an electronic copy. Nine states, including Florida and Arkansas, don’t have pay stub laws at all, which means you don’t have to provide, but if you opt to do so, email is acceptable.

What information is required on a pay stub?

General information like name, pay rate, gross pay, and deductions are common and can be found on most pay stubs, but state law dictates the specific information you should include. California requires employers to display the last four digits of an employee’s Social Security number or employee identification number on each stub. The majority of pay stub templates you find will have space for the most common data. You’ll need to check your state laws for any unique requirements.

Do independent contractors receive pay stubs?

No, independent contractors don’t receive pay stubs; if you pay them more than $600 within the year, you’ll issue a 1099 Form with total pay information instead. Pay stubs are typically used to report income, taxes, and other deductions withheld for employees. You don’t withhold taxes from a contractor’s pay unless there are extenuating circumstances such as that they refuse to complete Form W-9, nor health and retirement benefits.

Bottom Line

When you first start your business, you may pay workers with handwritten checks or cash. If you’re not using a payroll service, it’s important to document all payments and any taxes and deductions withheld. Pay stubs are a great way to meet the DOL’s payroll document retention requirements, even if they aren’t required.

If your state requires you to provide pay stubs to your employees, consider using a payroll service. Gusto is a small business payroll software that calculates and files payroll taxes—federal, state, and local—pays employees through direct deposit or printed checks, and lets employees print their own payroll reports and pay stubs.